Freedom Apex Enterprise & Financial Services

"Speed Breeds Success"

"Where Building Is Helping You Win"

Click Here for Free Information to Improve Your Credit

Benefits of Having Good Credit

Improving your credit has several important benefits that can positively impact various aspects of your financial life. Here are some key reasons why you may want to focus on improving your credit:

Lower Interest Rates: A higher credit score often translates to lower interest rates on loans and credit cards. With an improved credit score, you are more likely to qualify for loans and credit cards with favorable terms, saving you money on interest payments.

Easier Loan Approval: Lenders use credit scores as a key factor in determining loan approval. A higher credit score increases your chances of being approved for various types of loans, including mortgages, auto loans, and personal loans.

Access to Better Credit Cards: A good credit score makes you eligible for premium credit cards with attractive rewards programs, cashback offers, and other benefits. These cards typically have lower fees and better perks.

Renting a Home: Landlords often check credit scores as part of the rental application process. A higher credit score can make it easier to secure a rental property and may even lead to lower security deposits.

Employment Opportunities: Some employers conduct credit checks as part of the hiring process, especially for positions that involve financial responsibilities. A better credit score may enhance your employment prospects in certain industries.

Insurance Premiums: In some cases, insurance companies use credit scores to determine premiums for auto and homeowners’ insurance. A higher credit score may result in lower insurance costs.

Negotiating Power: When applying for loans or negotiating terms with creditors, a strong credit profile gives you more negotiating power. Lenders may be more willing to work with you on interest rates and loan terms.

Qualification for Rewards Programs: Beyond credit cards, some companies offer rewards programs for various services based on your creditworthiness. This includes better rates on cell phone plans, utilities, and more.

Financial Flexibility: A good credit score provides you with financial flexibility. You can access credit when needed, allowing you to navigate unexpected expenses or take advantage of investment opportunities.

Building a Positive Financial Reputation: A positive credit history contributes to building a strong financial reputation. Responsible credit management reflects well on your overall financial responsibility.

Homeownership Opportunities: A higher credit score improves your eligibility for a mortgage with favorable terms. It can make the homebuying process smoother and more affordable.

Credit Limit Increases: With a higher credit score, you are more likely to receive credit limit increases on your existing credit cards. This can improve your credit utilization ratio, a key factor in your credit score.

Improving your credit takes time and discipline, but the long-term benefits can be substantial. By maintaining good credit habits, you enhance your financial stability and open doors to better financial opportunities.

Click Here for Free Information to Improve Your Credit

How to Improve Your Credit

Improving your credit takes time and consistent effort. Here are steps you can take to enhance your credit score:

Check Your Credit Report: Obtain free copies of your credit reports from major credit bureaus (Equifax, Experian, and TransUnion). Review them for inaccuracies or errors. Dispute any discrepancies you find.

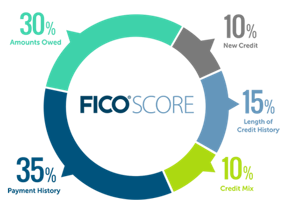

Pay Bills on Time: Consistently pay your bills on time, including credit cards, loans, and utility bills. Payment history is a significant factor in your credit score.

Reduce Credit Card Balances: Aim to keep credit card balances low relative to your credit limits. High credit card balances can negatively impact your credit utilization ratio, a crucial factor in your credit score.

Avoid Opening Too Many New Accounts: Opening multiple new credit accounts within a short period can be seen as a red flag. Limit new credit applications to those necessary and be mindful of how they may affect your credit.

Diversify Your Credit Mix: Having a mix of different types of credit, such as credit cards, installment loans, and a mortgage, can positively impact your credit score. However, don't open new credit accounts just for the sake of variety.

Pay Off or Settle Collections: If you have outstanding collections, work to pay them off or negotiate settlements. Settled collections are generally better for your credit than unresolved ones.

Negotiate with Creditors: If you're facing financial challenges, contact your creditors to discuss hardship programs, repayment plans, or settlement options. Some creditors may be willing to work with you.

Become an Authorized User: If you have a family member or friend with a positive credit history, ask if you can become an authorized user on their credit card account. Their positive payment history may be reported on your credit report.

Use Secured Credit Cards: If you have difficulty obtaining a traditional credit card, consider a secured credit card. These cards require a security deposit but can help you build or rebuild credit.

Keep Old Accounts Open: The length of your credit history is a factor in your credit score. Avoid closing old credit card accounts, as they contribute to the average age of your credit.

Be Patient: Improving your credit is a gradual process. Be patient and consistent in your efforts and avoid quick-fix schemes that promise rapid results.

Seek Professional Advice: Consider consulting with a credit counseling agency for personalized advice on managing your debts and improving your credit.

Educate Yourself: Learn about credit scoring and personal finance to make informed decisions. Understanding how credit works can empower you to make better financial choices.

Remember that positive changes in your credit score may take time. Focus on responsible financial habits, and over time, you'll likely see improvements in your creditworthiness. If you're facing challenges, don't hesitate to seek guidance from financial professionals or credit counselors.

Click Here for Free Information to Improve Your Credit

Credit Coaching Improvement Program

Do you know your credit score? When is the last time you ordered a copy of your credit report? For many of us, the world of finance can be confusing, hard-to-navigate, and is filled with acronyms and terminology that can leave you with more questions than answers. Most of us don’t bother to order a copy of our credit report or track our credit score unless we’re making a big financial decision such as buying a home or car or ensuring identity thieves haven’t opened additional lines of credit in our name.

Like a personal trainer, our Credit Coaching Improvement Program will provide personalized and accurate information to help you have a better understanding of your credit score and how it’s calculated, as well as work toward achieving your financial goals.

Sign up now to get the coaching you need to achieve your financial goals through credit coaching!

Two options available:

Option 1 - One time payment of $599.95

Option 2 - Two payments of $324.98 (Total $649.95) (Second payment due within 30 days of the first payment.)

Click here to sign up for Option 1

Click here to sign up for Option 2

Click Here Now To Get More Information and Complete Survey

Click Here to Enroll Today

IDENTITY THEFT PROTECTION

We take credit and identity monitoring to the next level as we alert you to suspicious activity, patrol the dark web for your personal information, provide $1 million in identity theft insurance and more.

CREDIT SCORES & REPORTS

Suspicious changes in your credit report are one of the first indications that your personal information might be compromised. We help you take control by providing your credit scores and reports so you can verify your information and take action if needed.

DATA BREACH

Our industry-leading services help businesses prepare and manage data security breaches. We provide preparation planning and support every step of the way, from pre-breach to post-breach, so you are ready to respond in the unfortunate event of a data breach.

SECURITY AWARENESS TRAINING

Our services feature educational resources, phishing tests, ransomware simulators and other training tools that provide the instruction needed to help prevent cyberattacks in today’s digital world.